Social networks of corporate citizens

The name of this blog, Memetix, reflects my interest in the propagation of memes1. A related idea is that of social networks, about which much theoretical material has been written. Memes propagate from node to node (person to person) along the “edges” (technical term for links between people) of the network, and spread faster if they hit a node which is “central” in some sense.

As you can imagine, sociologists are quite interested in social networks. However, the study of social networks is also a big deal in business circles. A recent

Mapping social networks can be useful in many ways, but [Wharton management professor] Rosenkopf says there are at least two reasons why corporate interest in the subject is growing: Companies want to be able to identify key performers and get a better understanding of the nature of the interaction among employees.

"Hopefully, you have organized your company the best way to get the job done," she says. "But mapping out a network will give you a sense of whether actual work flow and communication flow match what you hope to achieve. Maybe there are bottlenecks where one person is managing all interactions. If you expect two groups to work together closely, and you don't see them doing this, you might want to create liaison roles or other relationships to make information flow better. On the other hand, you may see groups talking to each other too much. When managers see network diagrams, they often realize they need to reconfigure their organizational chart."

The internet is a gigantic social network, and has been studied by Albert-Laszlo Barabasi, an important mathematician. An MIT researcher, C. Marlow, is interested in studying how news travels through the blogosphere:

We have constructed a system to track memes within the weblog community. As a meme diffuses through social ties, our system documents the time and location for each posting that is observed. Based on these data, webloggers can be categorized by their adoption characteristics, ranging from early- to late-adopters.

Yes, dear friends, you are being studied.

Interlocking directorates -- defined as the linkages among corporations created by individuals who sit on two or more corporate boards -- have been a source of research attention since the Progressive Era at the turn of the 20th century, when they were used by famous muckraking journalists, and future Supreme Court Justice Louis Brandeis, to claim that a few large commercial and investment banks controlled most major corporations.

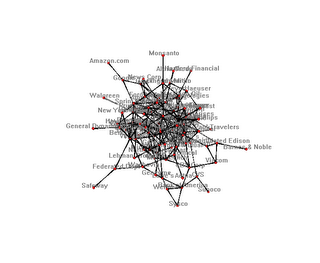

Drawing inspiration from the site They Rule, which provides a graphical tool for researching corporate board memberships and interlocking directorates, I consider two corporations to be linked if they share a board member (or if an officer in one company sits on the board of another). Unfortunately, the data at They Rule is from 2004 and not available in a format necessary for social network analysis. Consequently, I spent the day downloading board information from Reuters. The data used for this analysis consists of the top 100 companies (in gross revenue), minus six companies for which data were difficult to obtain and including an additional 27 companies that are involved in defense, media, or pharmaceuticals. Clearly the 27 extra companies reflect the bias of my own personal interests. Eventually I plan to expand the analysis.

Table 1: Social Network Measures for Individual Companies

| | Centrality | Between | Close | | Centrality | Between | Close |

| Company | Degree | ness | ness | Company | Degree | ness | ness |

| Citigroup | 34 | 1089 | 0.42 | Dow Chemical | 8 | 182 | 0.34 |

| General Electric | 20 | 455 | 0.38 | | 8 | 102 | 0.32 |

| Pepsico | 20 | 435 | 0.38 | General Motors | 8 | 52 | 0.33 |

| Verizon | 20 | 471 | 0.37 | Hewlett Packard | 8 | 74 | 0.31 |

| Honeywell | 18 | 337 | 0.35 | Lockheed Martin | 8 | 126 | 0.30 |

| Target | 18 | 400 | 0.38 | New York Times | 8 | 48 | 0.32 |

| Du Pont | 16 | 169 | 0.35 | Northrop Grumman | 8 | 65 | 0.30 |

| Pfizer | 16 | 123 | 0.34 | Sears | 8 | 112 | 0.31 |

| Procter & Gamble | 16 | 262 | 0.37 | United Parcel | 8 | 109 | 0.32 |

| Walt Disney | 16 | 322 | 0.33 | Wachovia | 8 | 123 | 0.32 |

| Boeing | 14 | 191 | 0.34 | Yahoo | 8 | 108 | 0.31 |

| Chubb | 14 | 261 | 0.34 | ADP | 6 | 58 | 0.33 |

| Coca Cola | 14 | 159 | 0.35 | AIG | 6 | 38 | 0.28 |

| ConocoPhillips | 14 | 183 | 0.36 | Albertson's | 6 | 27 | 0.27 |

| Dell | 14 | 166 | 0.34 | CVS | 6 | 129 | 0.25 |

| Exxon | 14 | 137 | 0.34 | Federated Dept | 6 | 102 | 0.28 |

| Ford Motor | 14 | 296 | 0.35 | Google | 6 | 114 | 0.27 |

| Goldman Sachs | 14 | 130 | 0.34 | International Paper | 6 | 22 | 0.31 |

| IBM | 14 | 236 | 0.35 | Kroger | 6 | 39 | 0.30 |

| United Technologies | 14 | 262 | 0.36 | Lowe's | 6 | 131 | 0.31 |

| American Express | 12 | 187 | 0.34 | Merck | 6 | 19 | 0.31 |

| | 12 | 189 | 0.37 | News Corp | 6 | 5 | 0.30 |

| Deere | 12 | 135 | 0.35 | TimeWarner | 6 | 46 | 0.33 |

| Dow Jones | 12 | 111 | 0.34 | United Health | 6 | 21 | 0.31 |

| FedEx | 12 | 123 | 0.33 | Viacom | 6 | 38 | 0.28 |

| Home Depot | 12 | 241 | 0.34 | Wellpoint | 6 | 61 | 0.27 |

| Merrill Lynch | 12 | 147 | 0.32 | WeyerHaeuser | 6 | 29 | 0.28 |

| Metlife | 12 | 123 | 0.31 | Wyeth | 6 | 5 | 0.31 |

| Motorola | 12 | 127 | 0.36 | Borders | 4 | 15 | 0.26 |

| Sprint Nextel | 12 | 68 | 0.32 | Calpine | 4 | 0 | 0.30 |

| Walmart | 12 | 138 | 0.34 | Costco | 4 | 5 | 0.26 |

| Wells | 12 | 241 | 0.35 | HCA | 4 | 0 | 0.31 |

| Abbott Labs | 10 | 87 | 0.35 | Ingram Micro | 4 | 19 | 0.27 |

| Alcoa | 10 | 64 | 0.34 | Lehman Brothers | 4 | 8 | 0.30 |

| Allstate | 10 | 92 | 0.32 | McKesson | 4 | 29 | 0.28 |

| AT&T | 10 | 87 | 0.30 | Raytheon | 4 | 14 | 0.31 |

| Bank of | 10 | 192 | 0.28 | | 4 | 0 | 0.28 |

| Cardinal Health | 10 | 114 | 0.32 | Sysco | 4 | 0 | 0.23 |

| CBS Corp | 10 | 166 | 0.30 | | 4 | 19 | 0.27 |

| Chevron | 10 | 152 | 0.32 | | 2 | 0 | 0.25 |

| Cisco | 10 | 210 | 0.34 | Altria Group | 2 | 0 | 0.26 |

| Haliburton | 10 | 84 | 0.35 | Amazon.com | 2 | 0 | 0.21 |

| Intel | 10 | 130 | 0.31 | Barnes & Noble | 2 | 0 | 0.24 |

| Johnson & Johnson | 10 | 117 | 0.34 | Coca-Cola Bottling | 2 | 0 | 0.24 |

| | 10 | 99 | 0.34 | Comcast | 2 | 0 | 0.30 |

| Microsoft | 10 | 92 | 0.34 | General Dynamics | 2 | 0 | 0.24 |

| Prudential Financial | 10 | 70 | 0.33 | Genzyme | 2 | 0 | 0.27 |

| | 8 | 77 | 0.30 | | 2 | 0 | 0.27 |

| Caterpillar | 8 | 18 | 0.30 | Monsanto | 2 | 0 | 0.23 |

| Choicepoint | 8 | 139 | 0.29 | Safeway | 2 | 0 | 0.22 |

| Coca-Cola Enterprises | 8 | 25 | 0.32 | Sunoco | 2 | 0 | 0.20 |

| Consolidated | 8 | 199 | 0.32 | Walgreen | 2 | 0 | 0.26 |

Labels: experimental

1 Comments:

Hi, left a comment on your most recent entry, but I thought I'd like to volunteer to download Reuters data, since I'm doing something similar anyhow. (I have almost a gigabyte of newspaper articles, wire photographs, white papers and reports, and other miscellania saved on various hard drives, as a reference database.)

I'm especially interested in information on transportation, oil, and engineering companies, but I'm not overly particular.

Post a Comment

<< Home